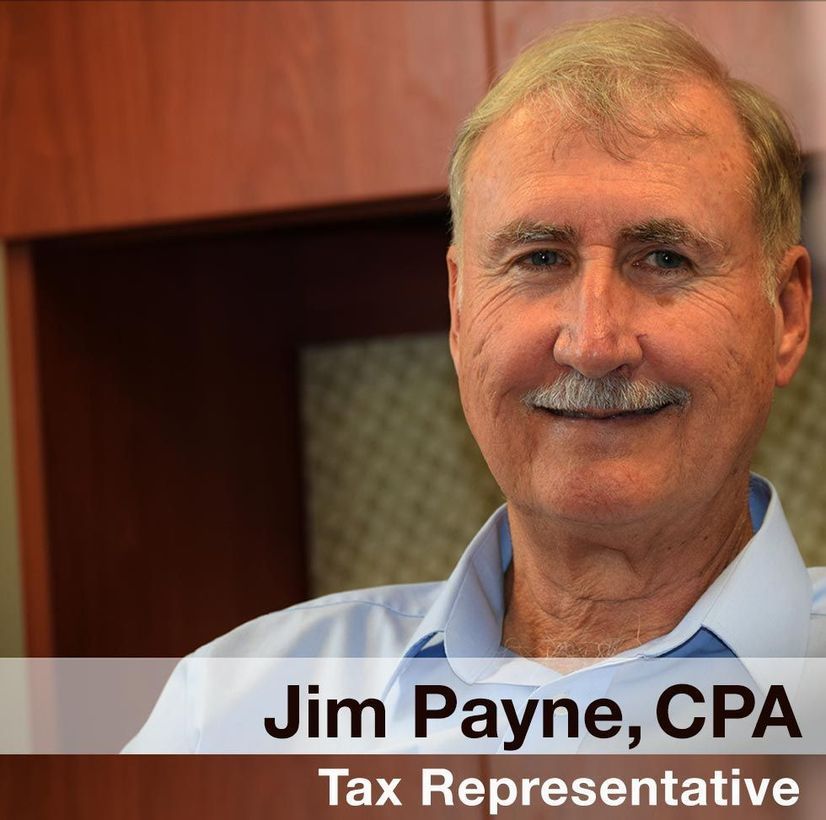

Whether you owe over $100K, haven’t filed in years, or face payroll tax penalties, I’ll help you create a personalized, judgment-free plan—direct from a CPA, all virtual, no outsourcing.

Tax Resolution & Relief Services

Are you struggling with tax debt and need help from a trusted professional in Gainesville, Florida? Look no further than Jim Payne, CPA. I provide you with the IRS tax debt relief services you need to navigate through your financial challenges. With my expertise and experience, I can help you negotiate with the IRS, resolve your tax issues, and ultimately pay less tax debt.

Navigating IRS Tax Debt Challenges

When it comes to resolving IRS tax debt issues, having an expert on your side can make all the difference. I offer comprehensive tax debt relief services to help you navigate through the complexities of dealing with the IRS. I am here to assist you every step of the way.

Personalized Tax Debt Solutions

Dealing with IRS tax debt can be a daunting task, but with the right guidance and support, you can find a way out. Our team at Jim Payne, CPA specializes in helping individuals like you navigate through IRS tax debt challenges with ease. I understand the complexities of the tax system and am here to provide you with the support you need to overcome your tax debt.

Trusted Tax Relief Services in Gainesville

Choosing the right tax relief service provider is crucial when dealing with IRS tax debt. At Jim Payne, CPA, I pride myself on offering trusted and reliable tax relief services to individuals in Gainesville, Florida. With my proven track record of success and commitment to client satisfaction, you can trust me to help you find relief from your tax debt issues.